WI A-771 2018-2026 free printable template

Show details

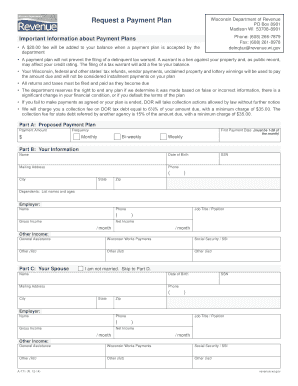

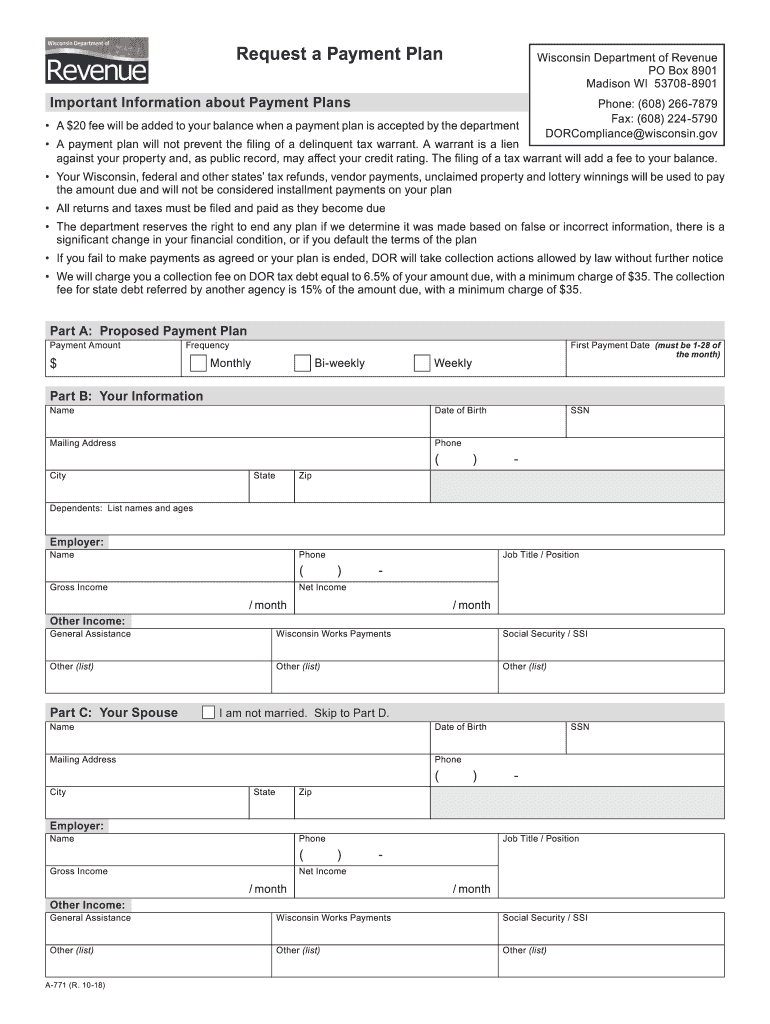

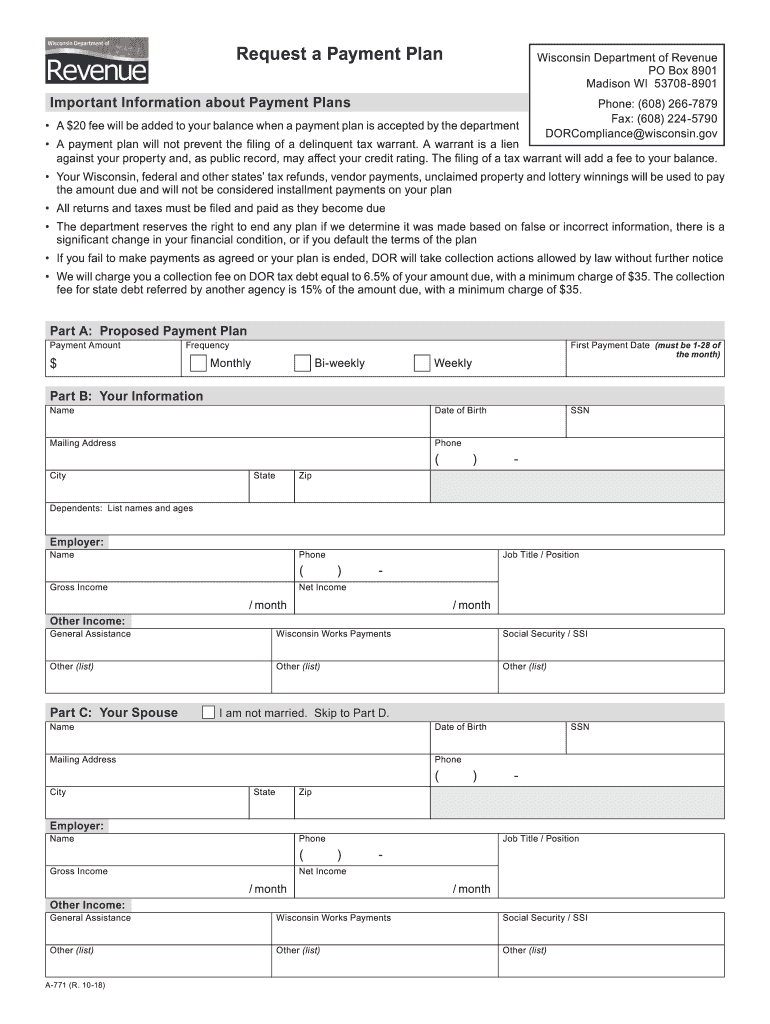

Save Request a Payment Plan Print Clear Wisconsin Department of Revenue PO Box 8901 Madison WI 53708-8901 Important Information about Payment Plans A 20 fee will be added to your balance when a payment plan is accepted by the department Phone 608 266-7879 Fax 608 224-5790 DORCompliance wisconsin.gov A payment plan will not prevent the filing of a delinquent tax warrant. A warrant is a lien against your property and as public record may affect your credit rating. The filing of a tax warrant...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign wi payment form

Edit your wisconsin payment plan online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a771a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit a771 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form a771a. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI A-771 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out wisconsin payment plan form

How to fill out WI A-771

01

Gather all required personal and financial information.

02

Begin with Section 1: Provide your personal identification details.

03

Move to Section 2: Fill in your employment information.

04

Complete Section 3: Disclose all income sources.

05

Fill out Section 4: List any deductions or expenses.

06

Review all provided information for accuracy.

07

Sign and date the form at the designated area.

08

Submit the completed WI A-771 to the appropriate agency.

Who needs WI A-771?

01

Individuals applying for unemployment benefits in Wisconsin.

02

Workers who are filing for job loss or wage loss compensation.

03

Those seeking to establish eligibility for state assistance programs.

Fill

wisconsin payment plan get

: Try Risk Free

People Also Ask about form a 771

What tax forms do I need?

What documents do I need to file my taxes? Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations. Tax deduction records. Expense receipts.

What is the minimum to file taxes in 2014?

Here are some basic guidelines: For single dependents who are under the age of 65 and not blind, you generally must file a federal income tax return if your unearned income (such as from dividends or interest) was more than $1,000; if your earned income (such as from wages or salary) was more than $6,100.

What is the minimum income to file taxes in 2013?

There is a minimum income to file taxes. If you are age 64 or younger, filing as single and earned more than $10,000.00 in 2013 ($11,500.00 if age 65 or older), then you are among those who have to file a tax return with the IRS this year.

What is form 2 Wisconsin?

Form 2 and Schedule 2K-1 Trusts, or portions of trusts, the assets of which consist of property placed in the trust by a person who is a resident of Wisconsin at the time that the trust became irrevocable if, at the time that the property was placed in the trust, the trust was revocable.

What is the minimum income to file taxes in 2014?

Here are some basic guidelines: For single dependents who are under the age of 65 and not blind, you generally must file a federal income tax return if your unearned income (such as from dividends or interest) was more than $1,000; if your earned income (such as from wages or salary) was more than $6,100.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit a771 request form from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including delnqtax wisconsin, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make edits in wisconsin department of revenue payment plan without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing tax file and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I complete wisconsin department of revenue wage attachment garnishment form a 771 on an Android device?

Use the pdfFiller Android app to finish your wisconsin department of revenue and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is WI A-771?

WI A-771 is a form used by businesses to report certain financial and tax-related information to the Wisconsin Department of Revenue.

Who is required to file WI A-771?

Any business entity operating in Wisconsin that meets specific reporting requirements, such as certain types of income or sales thresholds, is required to file WI A-771.

How to fill out WI A-771?

To fill out WI A-771, businesses should gather necessary financial information, follow the form's instructions carefully, input the required data accurately, and ensure all sections are completed before submission.

What is the purpose of WI A-771?

The purpose of WI A-771 is to ensure compliance with Wisconsin tax laws by collecting necessary financial data from businesses for tax assessment and revenue purposes.

What information must be reported on WI A-771?

The information that must be reported on WI A-771 includes income, deductions, credits, and other relevant financial details pertaining to the business's activity in Wisconsin.

Fill out your WI A-771 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wisconsin State Tax Payment Plan is not the form you're looking for?Search for another form here.

Keywords relevant to wisconsin estimated tax payments form

Related to payment plan request form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.